Guide to auto leasing vs. buying in Europe: A Comprehensive Comparison

Exploring the nuances of auto leasing versus buying in Europe opens a doorway to understanding the intricacies of acquiring a vehicle in this diverse continent. This guide aims to shed light on the key factors influencing this decision, providing valuable insights for those navigating the European car market.

Delve into the details of financial considerations, eligibility requirements, and the overall processes involved in auto leasing and buying to make informed choices tailored to your needs.

Overview of Auto Leasing and Buying in Europe

Auto leasing and buying are common ways for individuals in Europe to acquire vehicles.

Key Differences between Leasing and Buying

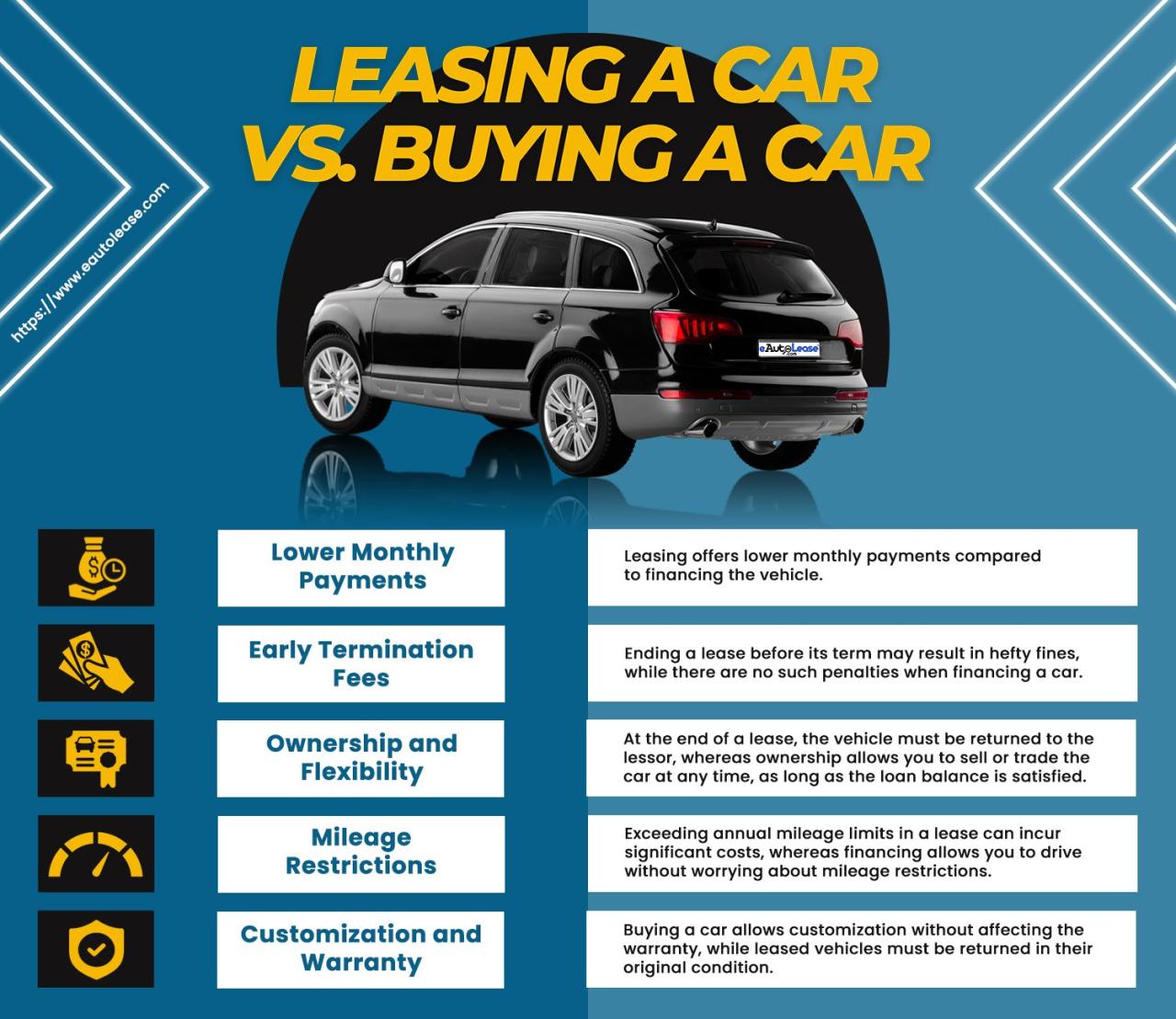

- Leasing involves paying for the use of a vehicle for a specified period, while buying means owning the vehicle outright.

- Leasing typically requires lower monthly payments compared to buying.

- Buying allows for customization and ownership of the vehicle, while leased vehicles must be returned at the end of the lease term.

Advantages and Disadvantages

When it comes to leasing, advantages include lower upfront costs and the ability to drive a new vehicle every few years. However, disadvantages may include mileage restrictions and the absence of ownership.

On the other hand, buying a vehicle provides the benefit of ownership, no mileage restrictions, and potential equity in the vehicle. Nevertheless, buying requires higher upfront costs and the responsibility of vehicle maintenance.

Popular Practices in European Countries

- In countries like Germany, auto leasing is a popular choice due to the flexibility it offers in terms of changing vehicles frequently.

- In the United Kingdom, buying a car is more common as it allows individuals to customize their vehicles and have full ownership.

- In France, a mix of both leasing and buying is observed, with individuals opting for the option that best suits their financial situation and needs.

Factors to Consider When Deciding Between Leasing and Buying

Deciding whether to lease or buy a car in Europe involves various factors that can significantly impact your financial situation and overall satisfaction with your vehicle. Let’s delve into some key considerations to help you make an informed decision.

Financial Aspects of Leasing vs. Buying

When comparing leasing and buying, it’s essential to consider the financial implications of each option. Leasing typically requires lower monthly payments compared to buying, as you are essentially paying for the vehicle’s depreciation over the lease term, rather than the full purchase price.

However, buying a car outright may result in higher initial costs but can be more cost-effective in the long run.

Impact of Depreciation on Decision-Making

Depreciation plays a crucial role in the decision-making process between leasing and buying. With leasing, you don’t have to worry about the vehicle’s depreciation, as you can simply return the car at the end of the lease term. On the other hand, owning a car means you bear the brunt of depreciation, which can significantly affect the car’s resale value and overall cost.

Flexibility of Leasing Agreements vs. Ownership

Leasing agreements offer more flexibility compared to ownership, as you can easily switch to a new car at the end of the lease term without the hassle of selling or trading in your vehicle. Leasing also allows you to drive a newer car with the latest features more frequently, providing a level of convenience that ownership may not offer.

Long-Term Costs of Leasing vs. Buying in Europe

When considering the long-term costs associated with leasing and buying a car in Europe, it’s important to factor in maintenance, insurance, registration fees, and potential penalties for exceeding mileage limits in a lease agreement. While leasing may seem cost-effective in the short term, buying a car outright can save you money in the long run, especially if you plan to keep the vehicle for an extended period.

Eligibility and Requirements for Auto Leasing in Europe

When it comes to leasing a car in Europe, there are certain eligibility criteria and requirements that individuals need to meet in order to secure a lease. Understanding these factors can help potential lessees navigate the process more effectively.

Typical Eligibility Criteria for Leasing a Car in European Countries

- Valid driving license: Most leasing companies in Europe require lessees to have a valid driving license from their home country or an international driving permit.

- Minimum age: The minimum age requirement for leasing a car varies by country but is typically around 21 years old.

- Income verification: Lessees may need to provide proof of income to ensure they have the financial means to make lease payments.

Documentation and Credit Score Requirements for Leasing a Vehicle

- Proof of identity: Lessees will likely need to provide a valid passport or identification card.

- Proof of address: Some leasing companies may require proof of address, such as a utility bill or bank statement.

- Credit score: A good credit score is often necessary to qualify for a car lease in Europe. Leasing companies will typically conduct a credit check to assess the lessee’s financial responsibility.

Specific Regulations or Restrictions Related to Auto Leasing in Europe

- Residency status: Residency status can impact leasing options in Europe. Non-residents may face additional requirements or restrictions when leasing a car.

- Insurance requirements: Some European countries have specific insurance requirements for leased vehicles, so lessees should be aware of these regulations.

How Residency Status May Affect Leasing Options

- Non-residents: Non-residents may need to provide additional documentation, such as proof of temporary residency or work visa, to lease a car in Europe.

- Residency duration: The length of time a person has been a resident in a European country can also impact their leasing options, as some leasing companies may prefer lessees with longer residency histories.

Process of Auto Leasing Versus Buying in Europe

When it comes to acquiring a vehicle in Europe, there are distinct processes for leasing and buying. Let’s delve into the steps involved in each method and compare the paperwork, legal aspects, and key players in the process.

Leasing a Car in European Markets

- Research and Choose a Vehicle: Start by researching different car models and determining the one that suits your needs and budget.

- Find a Leasing Company: Look for reputable leasing companies that offer competitive rates and favorable terms.

- Negotiate Terms: Discuss the lease terms, including the duration, mileage limits, monthly payments, and any additional fees.

- Submit Application: Provide the necessary documentation, such as proof of income and identification, to the leasing company for approval.

- Sign the Lease Agreement: Review the lease contract carefully and sign the agreement once you are satisfied with the terms.

- Take Delivery of the Vehicle: Once the lease is approved, you can pick up the car and start enjoying your new ride.

Paperwork and Legal Aspects

- Leasing: The lease agreement Artikels the terms and conditions of the lease, including responsibilities, penalties for early termination, and options at the end of the lease term.

- Buying: When purchasing a car, you will need to handle paperwork such as vehicle registration, insurance, and potentially financing agreements.

Role of Dealerships, Leasing Companies, and Financial Institutions

- Dealerships: They facilitate both leasing and buying transactions, assisting customers in choosing a vehicle and completing the necessary paperwork.

- Leasing Companies: Specialize in providing lease agreements and managing the leasing process, including vehicle maintenance and end-of-lease options.

- Financial Institutions: Offer financing options for both leasing and buying, helping individuals secure the necessary funds to acquire a vehicle.

Tips for Negotiating Favorable Terms

- Compare Offers: Obtain quotes from multiple dealerships, leasing companies, and financial institutions to leverage the best deal.

- Understand Fees: Be aware of any additional fees or charges associated with the lease or purchase before committing.

- Consider Resale Value: If buying, factor in the vehicle’s resale value to make an informed decision on the purchase.

- Seek Discounts: Look for promotions, rebates, or incentives that can help lower the overall cost of leasing or buying a car.

Closure

In conclusion, weighing the pros and cons of auto leasing and buying in Europe unveils a world of possibilities for consumers. By grasping the essential elements Artikeld in this guide, individuals can make confident decisions when acquiring their next vehicle, ensuring a satisfying and cost-effective experience.

General Inquiries

What are the typical eligibility criteria for auto leasing in Europe?

Eligibility criteria usually include age requirements, a valid driver’s license, proof of income, and sometimes a good credit score.

How does depreciation impact the decision between leasing and buying a car in Europe?

Depreciation affects the overall cost of ownership; leasing shields you from the full impact of depreciation compared to buying.

Are there specific regulations regarding auto leasing in European countries?

Regulations vary by country, but some common ones include limitations on lease terms, mileage restrictions, and maintenance responsibilities.

How can residency status influence auto leasing options in Europe?

Residency status can impact leasing terms, as non-residents may face higher upfront costs or stricter eligibility requirements.