Embark on the journey of Buy My House: Mortgage Pre-Approval Checklist & Current Rates in New York, where we delve into essential steps and details to aid in your home buying process.

Explore the intricacies of mortgage pre-approval, current rates in New York, property evaluation factors, and financial considerations to equip yourself with the knowledge needed for a successful purchase.

Mortgage Pre-Approval Process

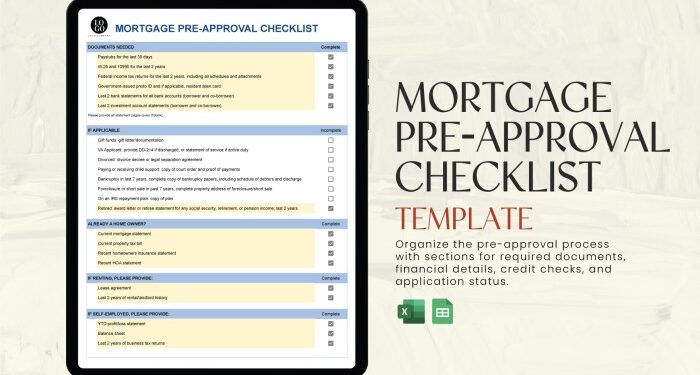

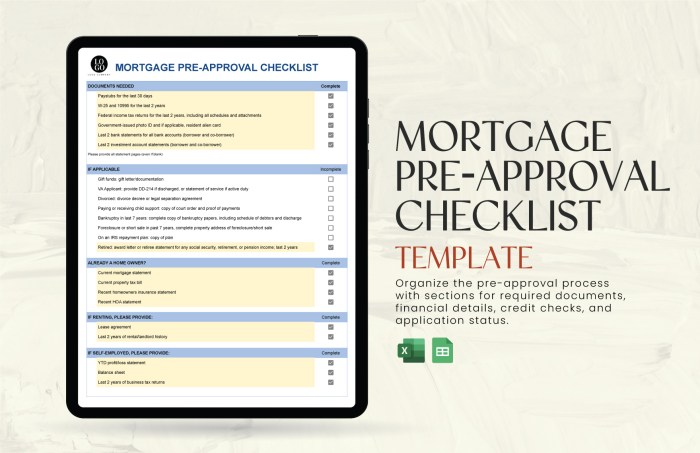

Obtaining a mortgage pre-approval is an important step in the home buying process as it shows sellers that you are a serious buyer with the financial capacity to purchase a home. Here are the steps involved in getting pre-approved for a mortgage:

Documents Required for Mortgage Pre-Approval

When applying for a mortgage pre-approval, you will need to provide various documents to the lender to assess your financial situation. These documents typically include:

- Proof of income such as pay stubs, W-2 forms, and tax returns

- Proof of assets including bank statements, investment accounts, and retirement savings

- Employment verification to confirm your current job status and income stability

- Credit history and credit score to determine your creditworthiness

- Information on any debts or liabilities you may have

Benefits of Getting Pre-Approved for a Mortgage

Getting pre-approved for a mortgage before house hunting has several advantages, including:

- Knowing your budget: Pre-approval helps you understand how much you can afford to spend on a home.

- Competitive advantage: Sellers are more likely to consider offers from pre-approved buyers as they have already been vetted by a lender.

- Faster closing process: Pre-approval can expedite the mortgage application process once you find a home you want to purchase.

- Peace of mind: Having pre-approval in hand gives you confidence when making an offer on a property.

Mortgage Rates in New York

When it comes to mortgage rates in New York, they can vary depending on several factors. It's essential for borrowers to stay informed about the current rates to make well-informed decisions.

Factors Influencing Mortgage Rates in New York

Several factors can influence mortgage rates in New York, including:

- Economic conditions: The state of the economy can impact mortgage rates. In times of economic growth, rates may rise, while in times of recession, rates may decrease.

- Market demand: High demand for mortgages can lead to higher rates, while low demand can result in lower rates.

- Credit score: Borrowers with higher credit scores typically qualify for lower interest rates.

- Loan term: The length of the loan can affect the interest rate, with shorter terms often having lower rates.

Locking in a Favorable Mortgage Rate

One way for borrowers to secure a favorable mortgage rate is by locking it in with the lender. This involves agreeing on a specific interest rate for a set period, typically until the loan closes. By locking in a rate, borrowers can protect themselves from potential rate increases while their loan application is processed.

Property Evaluation for Buying a House

When considering purchasing a house, there are several key factors to take into account during the property evaluation process to ensure a successful investment. One of the crucial steps is conducting thorough property inspections to identify any potential issues that may affect the value of the property.

Additionally, the location of the property plays a significant role in determining its overall value and long-term potential.

Factors to Consider When Evaluating a Property

- Condition of the Property: Assess the overall condition of the house, including the roof, foundation, plumbing, and electrical systems.

- Neighborhood and Community: Evaluate the safety, amenities, schools, and proximity to essential services in the neighborhood.

- Future Potential: Consider the potential for future growth and development in the area that could impact the property value.

Importance of Property Inspections Before Buying a House

- Identifying Potential Issues: Inspections help uncover any hidden problems such as structural issues, mold, or pests that could be costly to repair.

- Negotiating Power: Inspection reports provide leverage for negotiating the purchase price or requesting repairs from the seller.

- Peace of Mind: Knowing the condition of the property gives buyers confidence in their investment and prevents unexpected surprises after closing.

Impact of Property Location on Value

- Proximity to Schools and Work: Properties located near schools, businesses, and public transportation tend to have higher values due to convenience.

- Neighborhood Trends: Up-and-coming neighborhoods or areas experiencing revitalization can lead to increased property values over time.

- Crime Rates and Safety: Safer neighborhoods typically have higher property values, as buyers prioritize security and peace of mind.

Financial Considerations

When it comes to buying a house in New York, there are several financial considerations that can greatly impact your ability to secure a mortgage. From improving your credit score to understanding debt-to-income ratio, being well-informed about these factors is crucial in the home buying process.

Tips for Improving Credit Score

Improving your credit score is essential to securing a better mortgage rate in New York. Here are some tips to help boost your credit score:

- Pay your bills on time to avoid late payments.

- Keep your credit card balances low and avoid maxing out your credit limit.

- Avoid opening multiple new credit accounts at once.

- Check your credit report regularly for errors and dispute any inaccuracies.

Understanding Debt-to-Income Ratio

Debt-to-income ratio is a key factor that lenders consider when approving a mortgage. It is calculated by dividing your total monthly debt payments by your gross monthly income. A lower debt-to-income ratio indicates to lenders that you have a lower risk of defaulting on the loan.

Aim to keep your debt-to-income ratio below 43% to increase your chances of mortgage approval.

Types of Mortgage Loans in New York

There are several types of mortgage loans available for homebuyers in New York, each with its own benefits and requirements. Some common types include:

- Conventional Loans: Offered by private lenders and typically require a higher credit score and down payment.

- FHA Loans: Insured by the Federal Housing Administration, these loans are popular among first-time homebuyers with lower credit scores.

- VA Loans: Available to eligible veterans and service members, VA loans offer competitive interest rates and require no down payment.

- Jumbo Loans: Designed for high-priced properties, jumbo loans exceed the conforming loan limits set by Fannie Mae and Freddie Mac.

Last Word

In conclusion, Buy My House: Mortgage Pre-Approval Checklist & Current Rates in New York arms you with valuable insights to navigate the real estate market with confidence. Make informed decisions and secure your dream home effortlessly.

Quick FAQs

What documents are required for mortgage pre-approval?

To obtain mortgage pre-approval, you typically need documents like proof of income, assets, employment verification, and credit history.

How can borrowers lock in a favorable mortgage rate?

Borrowers can secure a favorable mortgage rate by timing their application when rates are low, improving credit score, and considering different lenders.

What factors impact mortgage rates in New York?

Factors like economic conditions, inflation rates, housing market trends, and Federal Reserve policies can influence mortgage rates in New York.

What types of mortgage loans are available for homebuyers in New York?

Homebuyers in New York can choose from options like fixed-rate mortgages, adjustable-rate mortgages, FHA loans, VA loans, and jumbo loans.